Page 6 - Index

P. 6

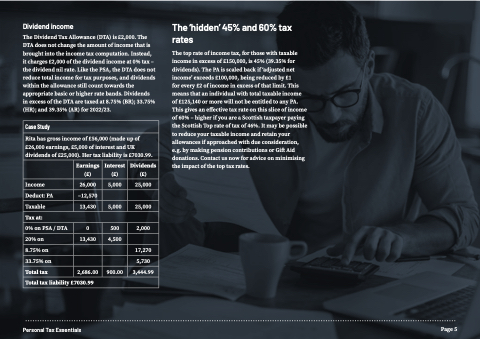

Dividend income

The ‘hidden’ 45% and 60% tax

rates

The top rate of income tax, for those with taxable income in excess of £150,000, is 45% (39.35% for dividends). The PA is scaled back if ‘adjusted net income’ exceeds £100,000, being reduced by £1

for every £2 of income in excess of that limit. This means that an individual with total taxable income of £125,140 or more will not be entitled to any PA. This gives an effective tax rate on this slice of income of 60% – higher if you are a Scottish taxpayer paying the Scottish Top rate of tax of 46%. It may be possible to reduce your taxable income and retain your allowances if approached with due consideration, e.g. by making pension contributions or Gift Aid donations. Contact us now for advice on minimising the impact of the top tax rates.

The Dividend Tax Allowance (DTA) is £2,000. The DTA does not change the amount of income that is brought into the income tax computation. Instead, it charges £2,000 of the dividend income at 0% tax – the dividend nil rate. Like the PSA, the DTA does not reduce total income for tax purposes, and dividends within the allowance still count towards the appropriate basic or higher rate bands. Dividends in excess of the DTA are taxed at 8.75% (BR); 33.75% (HR); and 39.35% (AR) for 2022/23.

Case Study

Rita has gross income of £56,000 (made up of £26,000 earnings, £5,000 of interest and UK dividends of £25,000). Her tax liability is £7030.99.

Earnings (£)

Interest (£)

Dividends (£)

Income

26,000

5,000

25,000

Deduct: PA

–12,570

Taxable

13,430

5,000

25,000

Tax at:

0% on PSA / DTA

0

500

2,000

20% on

13,430

4,500

8.75% on

17,270

33.75% on

5,730

Total tax

2,686.00

900.00

3,444.99

Total tax liability £7030.99

Personal Tax Essentials

Page 5