Page 22 - Index

P. 22

• make a living Will (also called ‘advance decisions’): so that your wishes are clear with regard to medical treatment in the event that, for example, you were seriously injured following an accident

• execute a lasting power of attorney: so that if you become unable to manage your affairs as a result of an accident or illness, responsibility will pass to a person of your choosing.

Remember to tell your spouse, your parents

and your business partners where your Will and related documents are kept. If you are passing on responsibility for managing your affairs, it might be advisable to talk matters through with them.

Unclaimed assets?

Billions of pounds of assets lie unclaimed in the

UK! To see if you have lost assets contact the Unclaimed Assets Register on 0333 000 0182 or visit www.uar.co.uk (NB: a charge applies for this service). To find out if you have an unclaimed Premium Bond prize, call 08085 007 007 or visit www.nsandi.com.

Non-UK domiciles

A UK resident and domiciled individual is taxed on worldwide income and gains. Non-UK domiciles who are UK resident can claim the remittance basis of taxation in respect of foreign income and gains, with the effect that they are only taxed if foreign income and gains are brought into the UK. They will however lose their entitlement to the personal allowance for income tax and the annual CGT exemption. There may also be a significant ‘remittance basis charge’ to pay. The non-UK domicile is also potentially favourably

treated for IHT, as they only pay IHT in respect of UK assets, as opposed to their worldwide assets.

An individual who has been resident for at least 15

of the last 20 tax years will be deemed UK domiciled for all tax purposes. In addition, those who had a UK domicile at the date of their birth will revert to having a UK domicile for tax purposes whenever they are resident in the UK, even if, under general law, they have acquired a domicile in another country.

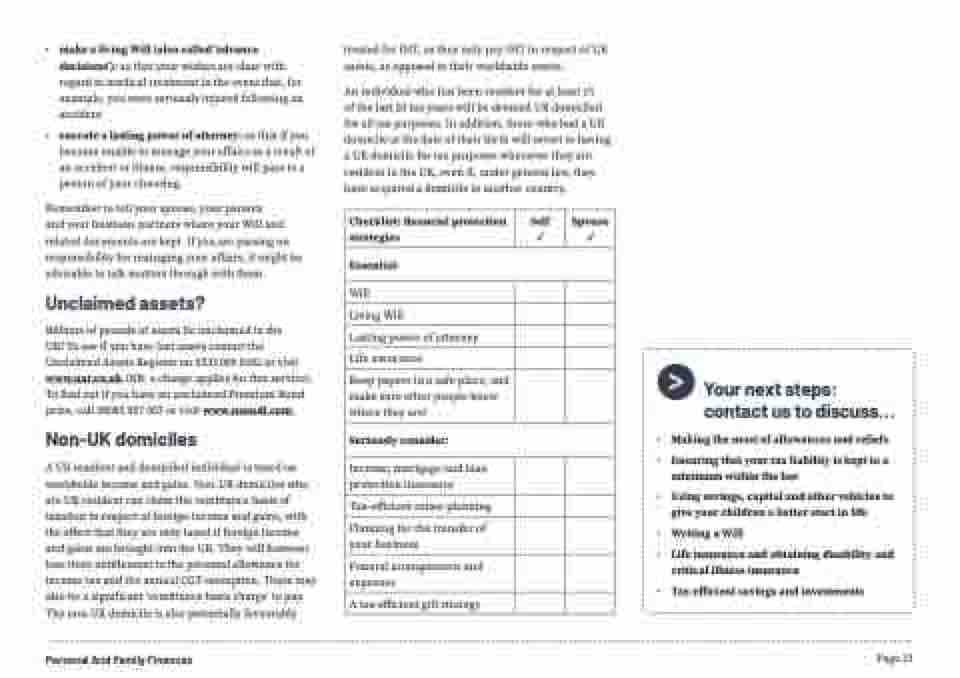

Checklist: financial protection strategies

Self ✓

Spouse ✓

Essential:

Will

Living Will

Lasting power of attorney

Life assurance

Keep papers in a safe place, and make sure other people know where they are!

Seriously consider:

Income, mortgage and loan protection insurance

Tax-efficient estate planning

Planning for the transfer of your business

Funeral arrangements and expenses

A tax-efficient gift strategy

Your next steps:

contact us to discuss...

• Making the most of allowances and reliefs

• Ensuring that your tax liability is kept to a

minimum within the law

• Using savings, capital and other vehicles to give your children a better start in life

• Writing a Will

• Life insurance and obtaining disability and

critical illness insurance

• Tax-efficient savings and investments

Personal And Family Finances

Page 21