Page 14 - Index

P. 14

Most benefits are fully taxable, but some attract specific tax breaks.

Salary Sacrifice and Optional

Remuneration Arrangements

(OpRAs)

Rules have been introduced where BIK have been offered through salary sacrifice or OpRAs, such

Employer contributions to a registered employer pension scheme or your own personal pension policies are not liable for tax or NICs. Please be aware that while your employer can contribute to your personal pension scheme, these contributions are combined with your own for the purpose of measuring your total pension input against the ‘annual allowance’.

The company car

The company car continues to be an important part of the remuneration package for many employees, despite the rises in the taxable benefit rates over the last few years.

Employees and directors pay tax on the provision of the car and on the provision of fuel by employers for private mileage. Employers pay Class 1A NICs at 15.05% on the same amount.

This is payable by the 19 July following the end of the tax year.

The charge on cars is generally calculated by multiplying the list price of the car by a percentage which depends on the CO2 emissions (recorded on the

that an income tax and NIC charge will arise on the higher of the salary sacrificed (or cash option) and the value of the BIK taken. By taking the BIK, the only saving made will be in employee NICs. All BIK are covered by these rules except for employer pension contributions; childcare provided in workplace nurseries and Employer Supported Childcare (usually by way of childcare vouchers); cycle to work schemes; and ultra-low emission cars.

Contributing to a pension scheme

Travel and subsistence costs

Site-based employees may be able to claim a deduction for travel to and from the site at which they are working, plus subsistence costs when they stay at or near the site.

Employees working away from their normal place of work can claim a deduction for the cost of travel to and from their temporary place of work, subject to a maximum period.

An attractive remuneration package might include any of the following:

• A salary

• Bonus schemes and performance-related pay

• Reimbursement of expenses

• Pension provision

• Life assurance and/or healthcare

• A mobile phone

• Optional Remuneration Arrangements (OpRAs)

• Share incentive arrangements

• Trivial benefits-in-kind (BIK) (worth no more than £50 each)

• The choice of a company car

• Additional salary and reimbursement of car expenses for business travel in your own car

• Contributions to the additional costs of working at home

• Other benefits including, for example, an annual function costing not more than £150 (including VAT) per head, or long service awards.

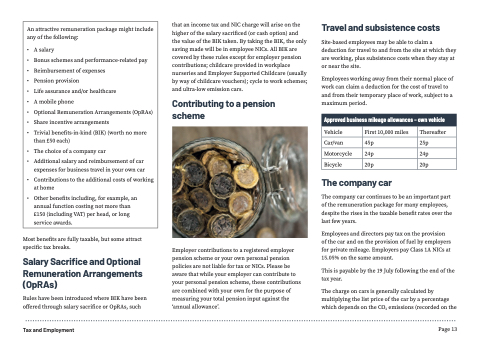

Approved business mileage allowances – own vehicle

Vehicle

First 10,000 miles

Thereafter

Car/van

45p

25p

Motorcycle

24p

24p

Bicycle

20p

20p

Tax and Employment

Page 13